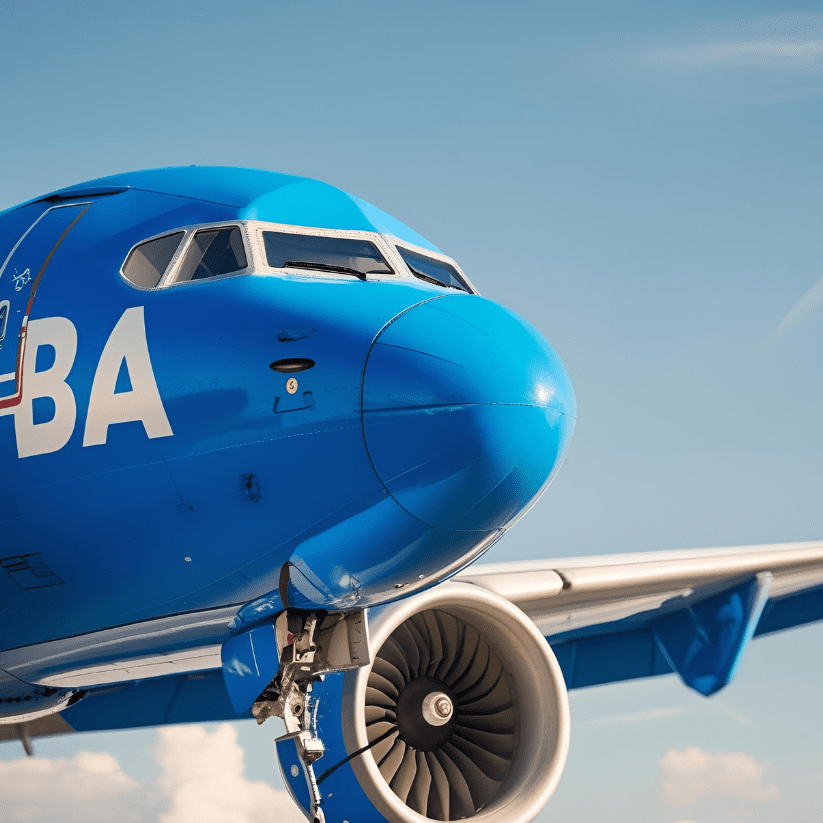

✈️ British Airways: A Legacy Carrier with Renewed Momentum

Founded in 1974 through the merger of four airlines, British Airways has become the flag carrier of the United Kingdom, operating globally from its hub at London Heathrow. With nearly 50 years of history, it remains a cornerstone of UK aviation and is part of the International Consolidated Airlines Group (IAG), listed on the London Stock Exchange and a constituent of the FTSE 100.

📈 Share Price & Performance (as of 22 July 2025)

- Share Price: 380.4p

- 1 Day: -0.94%

- 5 Days: +1.22%

- 1 Month: +2.03%

- Year to Date: +45.56%

British Airways has shown strong recovery and investor confidence, with its parent company IAG nearly doubling in value over the past year.

💰 Valuation Metrics

- P/E Ratio: 7.42 (Trailing)

- A low P/E suggests the stock may be undervalued relative to earnings.

- PEG Ratio: ~1.30 to 2.10 (based on recent reports)

- A PEG above 1 implies growth is priced in, but still reasonable given the sector’s rebound.

🧠 Conclusion

British Airways, via IAG, presents a compelling mix of legacy strength and growth potential. While its PEG ratio is higher than EasyJet’s, the low P/E and strong year-to-date performance suggest it’s still attractively valued. For investors seeking exposure to global aviation with a more diversified footprint, British Airways could be a strategic addition to the portfolio.

Want to compare this with Ryanair or Jet2 next? Or maybe visualize the performance trends with Chart.js?

Okay , found useful