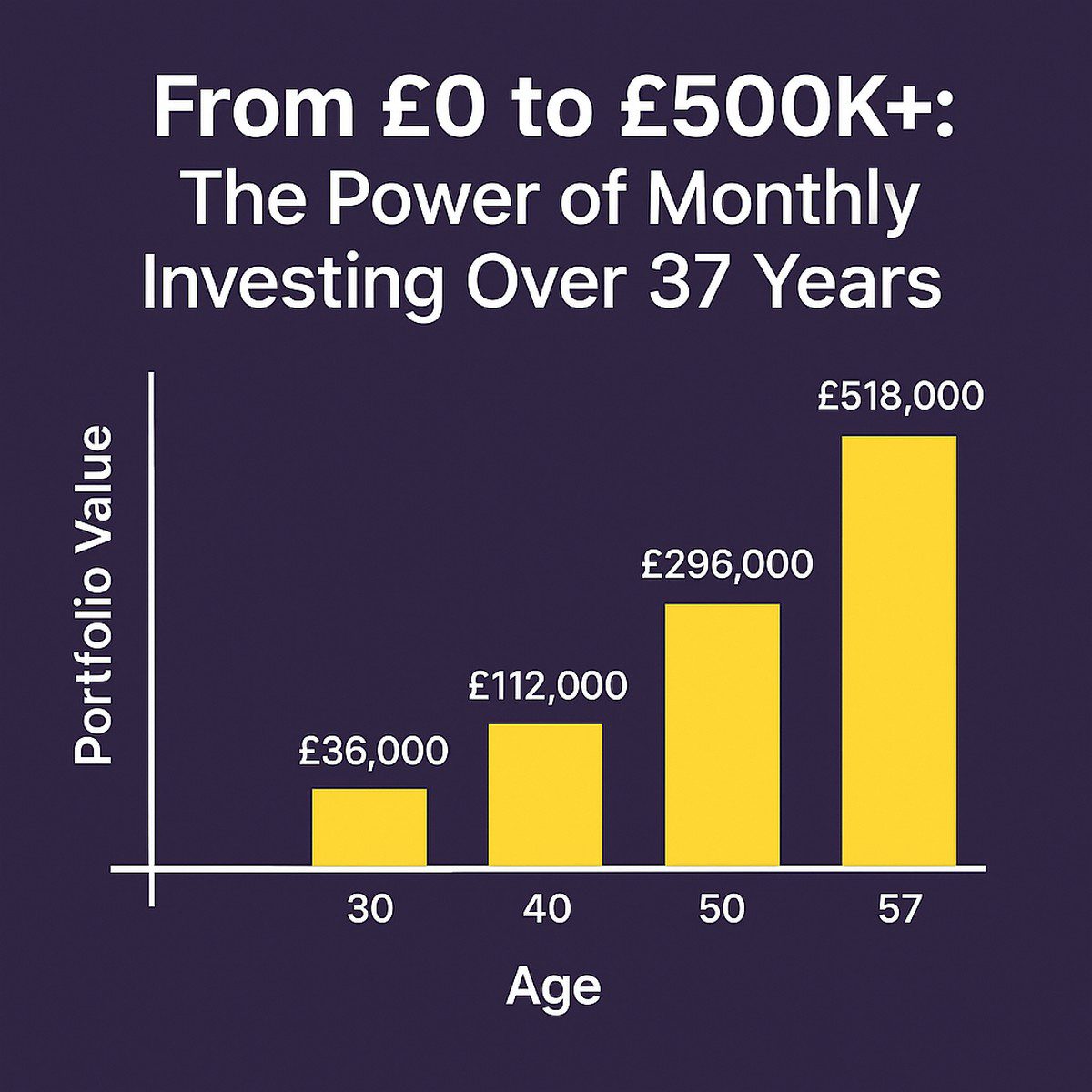

💼 From £0 to £500K+: The Power of Monthly Investing Over 37 Years

Imagine this: You’re 20 years old, just starting your career. You commit to investing £200 every month into a diversified portfolio—perhaps a mix of global accumulating ETFs like CSP1, SWLD, and XNAQ. You stay consistent, never skipping a month, and your portfolio grows at an average 8% annually, compounded monthly. What happens by the time you’re 57?

📈 The Numbers: Simple Inputs, Powerful Outcome

- Monthly Contribution: £200

- Annual Growth Rate: 8% (compounded monthly)

- Investment Duration: 37 years (from age 20 to 57)

- Total Contributions: £88,800

- Portfolio Value at 57: £518,000+

That’s over £429,000 in growth, purely from compounding and discipline.

🧠 Why This Works: The Compounding Engine

Compounding means your money earns returns, and those returns earn returns. With monthly contributions, you’re constantly feeding the engine. Over time, the growth curve steepens dramatically:

| Age | Contributions | Portfolio Value |

|---|---|---|

| 30 | £24,000 | ~£36,000 |

| 40 | £48,000 | ~£112,000 |

| 50 | £72,000 | ~£296,000 |

| 57 | £88,800 | £518,000+ |

🧭 Portfolio Strategy: Keep It Simple, Keep It Global

To achieve this, you don’t need to chase trends or time the market. A sample portfolio might include:

- CSP1 (S&P 500) – US large-cap exposure

- SWLD (MSCI World) – Global developed markets

- XNAQ (Nasdaq 100) – Tech-heavy growth

- VFEM or XAXJ – Emerging Asia exposure

- GOVT or AGGH – Optional bond ballast for later years

Use accumulating ETFs to avoid dividend paperwork and maximize reinvestment.

🛡️ Risk Management: What to Watch

- Stay invested: Missing just a few top-performing months can cost tens of thousands.

- Avoid high fees: Stick to ETFs with TER ≤ 0.20%.

- Rebalance every 2–3 years: Shift weight as retirement nears.

- Consider FX exposure: GBP-based ETFs like CSP1 help reduce currency risk.

🧮 Final Thought: Time Is Your Greatest Asset

Starting early isn’t just helpful—it’s transformative. With just £200/month, you can build a portfolio that rivals many pensions. The key is consistency, low fees, and global diversification.