🏡 Mansion Tax Proposal Sparks Heated Debate Across the UK

Date: 26 October 2025

Location: London, United Kingdom

A new proposal from Chancellor Rachel Reeves has reignited national debate over property taxation, as the government considers introducing a mansion tax targeting homes valued over £2 million. The measure, reportedly under review for inclusion in the upcoming Autumn Budget, aims to generate revenue for public services while addressing wealth inequality.

💷 What Is the Mansion Tax?

The proposed tax would apply an annual levy to high-value residential properties, with thresholds starting at £2 million. While exact rates and exemptions are still under discussion, early reports suggest the tax could be progressive — increasing with property value tiers.

🗣️ Public Reaction

The proposal has drawn mixed responses:

- Supporters argue it’s a fair way to redistribute wealth and fund critical services like the NHS and education.

- Critics warn it could penalise long-term homeowners, especially retirees living in inherited or appreciating properties without high incomes.

Property industry groups have also raised concerns about potential impacts on the housing market, liquidity, and regional disparities — especially in London and the South East, where property values routinely exceed the threshold.

🏛️ Political Implications

The mansion tax has long been a politically sensitive topic. While previous governments floated similar ideas, none have implemented it. Reeves’ proposal signals a shift toward more assertive fiscal policy, aligning with Labour’s broader platform on wealth equity and public investment.

📊 What Comes Next?

- The proposal is expected to be debated in Parliament ahead of the November Budget Statement.

- Analysts anticipate revisions, including possible exemptions for primary residences, heritage properties, or those with limited income.

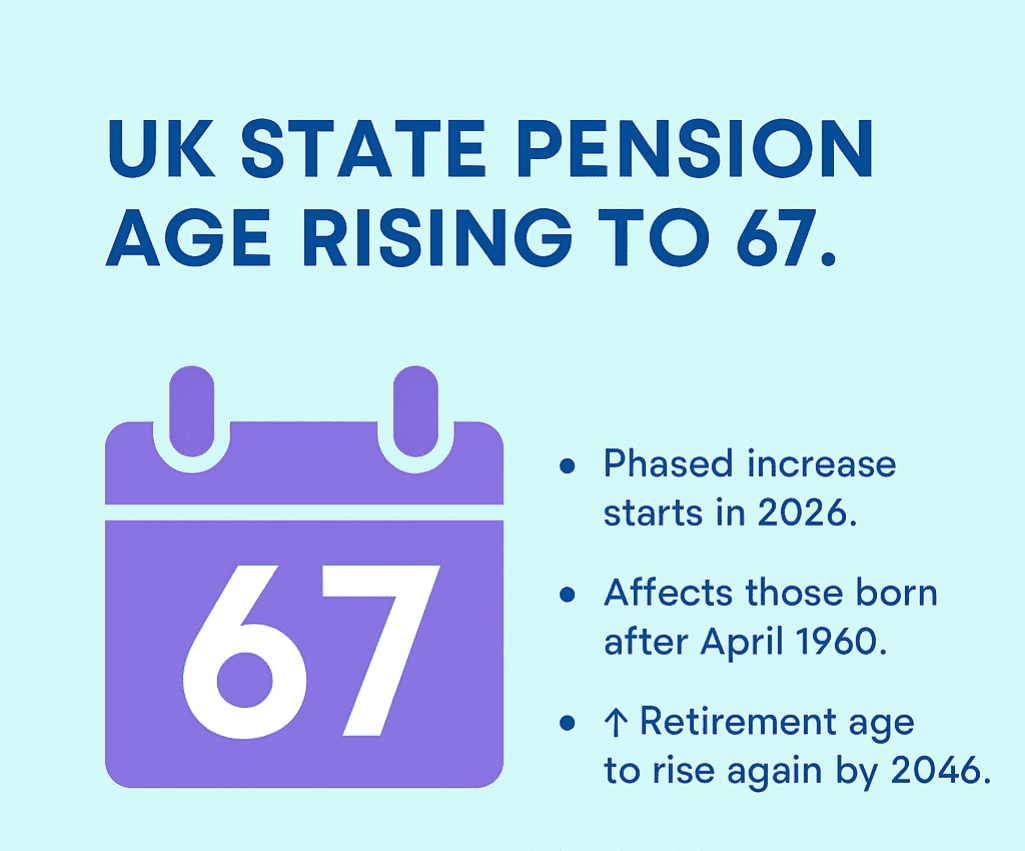

- If passed, implementation could begin in April 2026, with HMRC overseeing valuation and collection.

✒️ Final Thoughts

Whether viewed as a tool for fairness or a threat to property rights, the mansion tax proposal has opened a new chapter in the UK’s fiscal policy debate. As details emerge, homeowners, economists, and policymakers alike will be watching closely.