🪙 Company Overview: Endeavour Mining plc

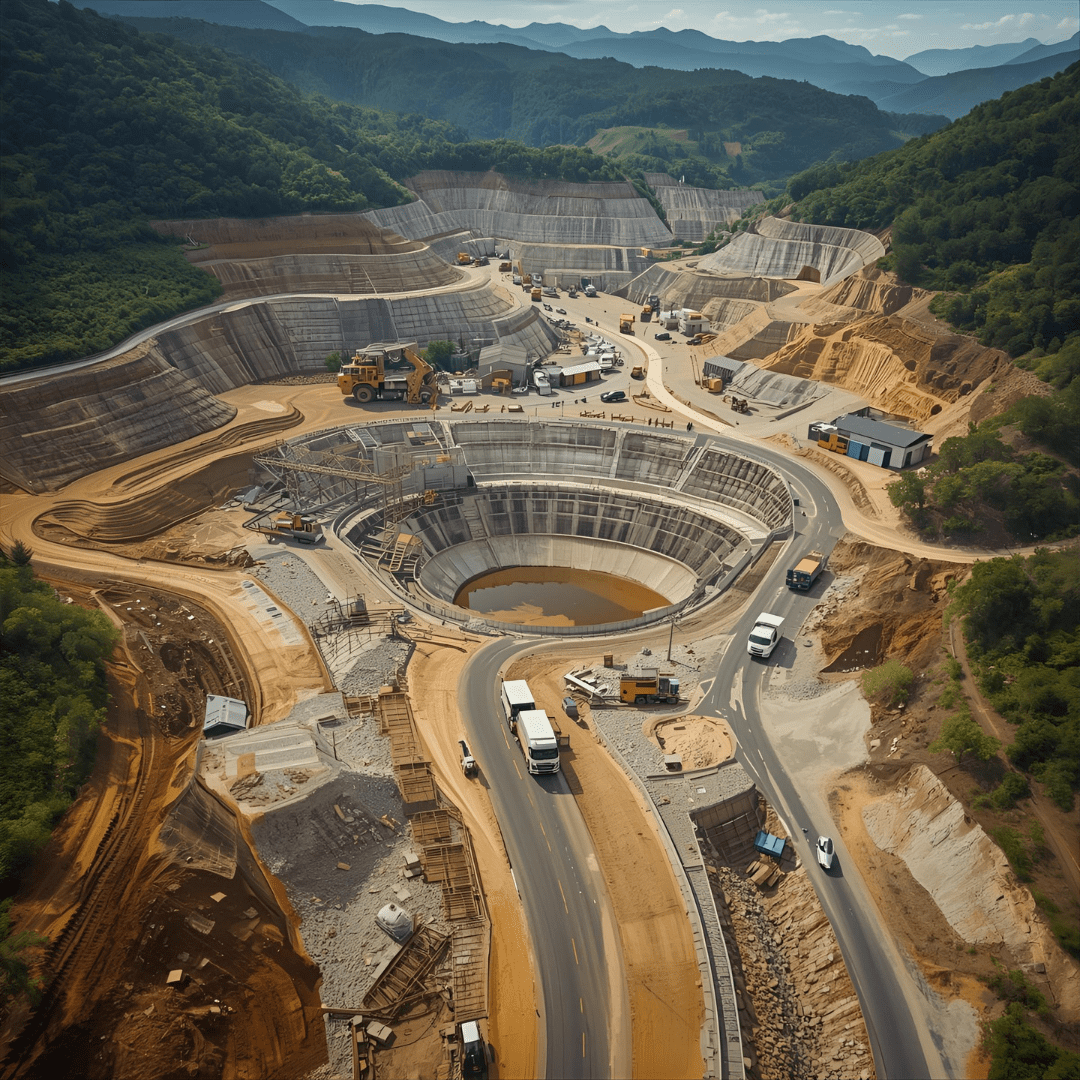

Endeavour Mining is a leading West African gold producer, headquartered in London and listed on both the LSE and TSX. Its portfolio includes:

- Operating Mines: Ity, Houndé, Mana, Sabodala-Massawa, and Boungou

- Development Projects: Lafigué (Côte d’Ivoire), Kalana (Mali)

- Exploration: Extensive pipeline across West Africa

The company focuses on low-cost, long-life assets, with strong ESG credentials and a commitment to shareholder returns through dividends and buybacks.

📊 Valuation Metrics (as of 15 Sept 2025)

| Metric | Value | Commentary |

|---|---|---|

| Share Price | 2,878.00p | Up +2.13% today |

| Market Cap | ~£6.65B | FTSE 100 constituent |

| P/E Ratio (TTM) | n/a | Negative earnings due to write-downs |

| EPS (FY 2024) | –120¢ | Reflects impairment and restructuring |

| Dividend Yield | ~2.65% | Attractive for a gold miner |

| Interim Dividend (2025) | 62¢ | Payable 23 Oct 2025 |

| 52-Week Range | 1,387p – 2,856p | Trading near its all-time high |

🧠 Strategic Highlights

- Production Growth: Driven by Sabodala-Massawa and Lafigué ramp-up

- Cash Flow: Strong operating cash flow supports buybacks and dividends

- Balance Sheet: Net debt reduced, maintaining financial flexibility

- ESG Focus: Water-efficient operations, biodiversity plans, and community investment

Endeavour offers exposure to gold price upside, with a diversified mine base and disciplined capital allocation. Its valuation reflects both growth potential and geopolitical risk in West Africa.